CDMO Samsung Biologics Announces Drug Development Deal With Kurma Partners

Samsung Biologics, one of the world’s largest contract development and manufacturing organizations (CDMOs), is partnering with health care and biotechnology venture capital firm Kurma Partners to provide chemistry, manufacturing, and control (CMC) services for Kurma’s portfolio companies. The partnership will give Kurma access to Samsung Biologics’ investigational new drug development process, with the goal of accelerating the selection of lead candidates and clinical development for new drugs.

“As we look to further expand our business opportunities globally, we are pleased to collaborate with Kurma Partners to support the growth of pioneering biotech companies,” said John Rim, President and CEO of Samsung Biologics. “With our in-depth knowledge on effective scale-up strategy and a diverse portfolio of proprietary platform technologies, we are looking forward to providing robust CMC solutions to reduce uncertainties, ensure regulatory compliance, and ultimately maximize manufacturing efficiency for our clients.”

“We are very excited to partner with Samsung Biologics, a world-leading CDMO with capabilities of highest industry standards. This will greatly benefit our portfolio of Kurma Biofunds and Kurma Growth Opportunities Fund in advancing large molecule biologics from discovery to the market,” said Daniel Parera, a partner at Kurma.

The agreement comes on the heels of Samsung Biologics’ construction of its fourth manufacturing plant at its headquarters in Songdo, South Korea. Completed in June, the plant is the largest of its kind, with 240,000 liters of manufacturing capacity. Samsung Biologics’ total capacity currently sits at an industry-leading 604,000 liters, accounting for roughly a quarter of global CDMO production.

Kurma will look to Samsung Biologics to help develop a portfolio that includes biotech companies across various stages of development working in areas such as gene-based diagnostics, treatments for endocrine system disorders, and cancer therapeutics.

Kurma’s Portfolio

Kurma, a Paris-based health care venture capital organization, has backed companies like Pharvaris, which is working on drugs to treat hereditary angioedema, and Amolyt Pharma, which is tackling rare hormonal and metabolic conditions with peptide-based treatments. Kurma’s investments are generally geared toward treating rare and underserved conditions.

The company is also investing in the integration of artificial intelligence into health care. Its portfolio includes a stake in Cardiologs, a company leveraging AI to transform cardiac diagnostics. Additionally, it’s focused on fostering advancements in treating genetic disorders. One of its portfolio companies is Orphazyme, a company working on treatments for lysosomal storage diseases, a cluster of genetic conditions that can lead to severe physical and mental disabilities.

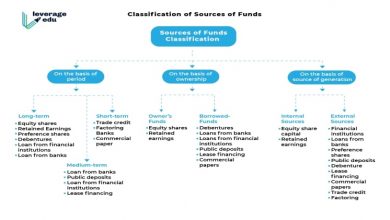

Samsung Biologics will focus on providing chemistry, manufacturing, and control services for Kurma’s portfolio companies. CMC services include designing drug formulas and specifying and executing the appropriate manufacturing steps, as well as setting up controls and tests for quality assurance.

Samsung Biologics’ CDMO Services

The Kurma partnership is part of Samsung Biologics’ continued expansion efforts. Its growth blueprint, outlined by Rim at the 2022 J.P. Morgan Healthcare Conference, involves enhancing capacity, growing geographic presence, and diversifying the company’s portfolio.

In 2023, the CDMO secured eight contracts valued at over 100 billion South Korean won (approximately $7.6 million) each. This surge in deals has led the company to adjust its annual revenue forecast to 3.6 trillion won, marking an increase of over 20% from the previous estimate.

For the third quarter of 2023, Samsung Biologics announced a consolidated revenue of 1.03 trillion won and an operating profit of 319 billion won. This performance was driven by the ramp-up of Plant 4, leading to a record-high quarterly revenue and an 18% year-over-year increase in revenue compared to the same period in the previous year. The company also reported a net profit of 240 billion won and earnings before interest, taxes, depreciation, and amortization of 457 billion won.

According to its Q3 earnings report, the company’s strategic partnerships have broadened to include 14 of the top 20 global pharmaceutical companies, and it has accumulated contracts valued over $11.8 billion.

Infrastructure development remains a cornerstone of Samsung Biologics’ growth. The company is gearing up to meet the surging demand for high-quality biologics. Plant 5 is a significant part of this trajectory, with an expected operational start in April 2025, which will add 180,000 liters of capacity.

“Given the continuing increase in the demand for outsourced manufacturing of biopharmaceuticals, we are proactively making this investment in alignment with our growth strategy to further strengthen our standing as a leading CDMO,” said Rim in a statement announcing the commencement of construction on Plant 5. “The new facility will enable us to provide our customers with even greater innovation and services that will increase speed to market and flexibility.”

Plant 5 is the first facility planned as part of Samsung Biologics second bio campus in Songdo. It will include an innovation hub to incubate new biotech companies, as well as several new manufacturing plants.