Liquidity and opportunities: how cash enables quick action in the markets

Are you looking to act quickly and have the ability to capitalise on market movements and opportunities? A large enough pool of liquid assets can be pivotal for investors wishing to take full advantage of whatever events or conditions may arise in today’s markets.

This article will cover why liquidity is essential in investment success, how cash reserves enable quick action, and outline different strategies that investors can employ if they lack adequate reserves but still want access to market opportunities. Read on for helpful tips and advice from experienced stock traders.

What is liquidity, and why is it essential for financial markets?

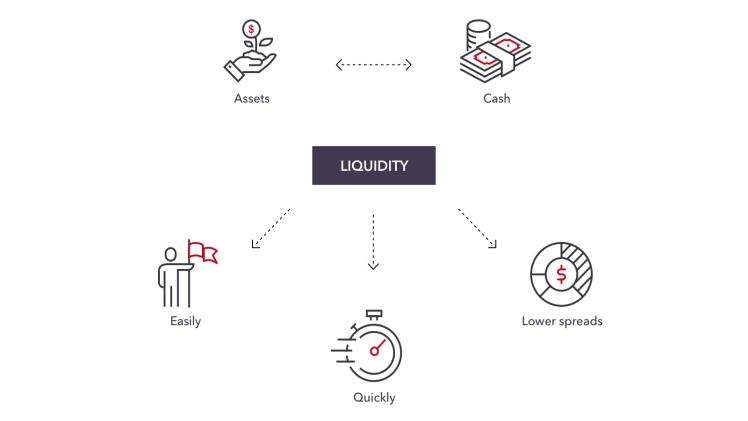

Liquidity is a crucial concept in financial markets that refers to the ease with which assets can be bought or sold without causing significant price movement. In other words, it measures the ability of investors to convert their investments into cash quickly and at a fair price. Liquidity is essential for several reasons, such as ensuring that financial markets run smoothly, reducing transaction costs, and efficiently facilitating capital allocation.

Investors seek liquidity for their investments to sell their assets quickly and easily without accepting a discount. When markets are illiquid, they can become volatile and subject to sharp and unpredictable price movements, leading to inefficiencies and potentially harming buyers and sellers. Therefore, liquidity is essential for a well-functioning financial system.

The benefits of having access to cash in the market

Having access to cash can prove to be invaluable when it comes to the market. In a world where cash is still widely accepted as a transaction, having it on hand can allow for quick and easy purchases without the hassle of setting up other forms of payment. Additionally, cash on hand can provide security regarding unexpected expenses or emergencies. In the market, cash can also be used for investment opportunities, allowing for the potential to earn a higher return on investment than other forms of payment.

Overall, the benefits of having access to cash in the market are numerous and can significantly benefit those who utilise this form of payment wisely. Understanding how cash is defined in investing and having the right amount of cash reserves can help investors access opportunities in the market quickly and confidently.

Evaluating liquidity levels in different markets

When evaluating liquidity levels in different markets, it is essential to consider various factors. One such factor is the size and depth of the market – more significant, more established markets generally have higher levels of liquidity than smaller, less mature ones. Additionally, certain asset classes are naturally more liquid than others; for example, stocks tend to be more liquid than bonds due to their higher trading volumes.

It is also essential to consider the amount of cash available; having adequate reserves on hand can provide a cushion for when markets become volatile or opportunities arise that require fast action. Finally, liquidity levels can vary significantly depending on the market environment. For instance, asset prices tend to drop more sharply than usual due to a lack of liquidity in times of crisis.

Leveraging cash to move quickly and seize opportunities

Access to cash can be highly beneficial for investors who want to move quickly and capitalise on opportunities in the market. Cash reserves provide investors with flexibility and control regarding their investments, allowing them to act swiftly when presented with good investment prospects.

In addition, having a large enough pool of liquid assets allows investors to take advantage of arbitrage opportunities, which arise when there is a temporary difference in the price of an asset between two or more markets. It can be beneficial during market volatility, allowing investors to take advantage of price discrepancies and capitalise on potential profits.

Managing risk through diversification and liquid investments

For those without adequate cash reserves, there are still ways to access opportunities in the market. Diversification is one strategy whereby investors spread their investments across multiple asset classes and markets to minimise risk and maximise returns. Additionally, liquid investments such as exchange-traded funds (ETFs) can provide instant liquidity and enable investors to access opportunities quickly.

Another way to manage liquidity risk is through hedging, which involves taking long and short positions in different asset classes to counterbalance potential losses. This strategy can protect against unexpected market movements without sacrificing the potential for returns.

Developing a strategy for taking advantage of market conditions with cash

A strategy for taking advantage of market conditions with cash is essential for any investor. Firstly, knowing how much cash you need to move quickly and capitalise on opportunities without over-allocating funds or taking on too much risk is crucial. Understanding different strategies, such as diversification and hedging, can help investors manage liquidity risk while still being able to access profitable opportunities.

Finally, investors should also be aware of the different types of investments available in the market and how they can be used to their advantage. Knowing which asset classes are more liquid and understanding when to move quickly based on the current market environment can help maximise returns while minimising risks. With a well-thought-out strategy, investors can make the most of their cash reserves and take advantage of the potential opportunities available in the market.